There is constant activity in web3. Projects launching, projects failing, Twitter fights between two cartoon characters that somehow have 50k followers…

With all of this hustle and bustle, it’s easy to lose sight of the underlying principles that make web3 promising in the long run. These principles, if applied correctly, have a real chance to disrupt the world as we know it.

Today I’m going to talk about my top 3 principles for web3.

Note that these are my top 3 principles. Web3 is constantly evolving, and could render these principles obsolete faster than the LUNA death spiral (still too soon?). To that end, I’ll provide a few counterpoints to each one of my examples – feel free to draw your own conclusions :)

1. Data is Commoditized

My favorite principle and the one I find the most powerful is that the data on blockchains are entirely open and free to consume. For example, it’s trivial to see the transaction history and balance of any wallet on the Ethereum blockchain:

Web2’s most precious resource, data, is no longer held in monopolistic, corporate silos but instead is free to use in any way. The implications of this newfound access are huge, and perhaps are the most apparent with social media applications. Social media applications aren’t currently interoperable: I can’t bring my Instagram followers to Twitter or my Twitter followers to Substack. I have to start from scratch every time I use a new platform!

In web3, the underlying data store is entirely open, making dapps interoperable and easy to use. Signing into any dapp with my wallet allows the application to leverage my existing data to customize my experience.

Counterpoint

People care about their privacy. Private blockchains (see Monero, Ironfish) will eat into the market share of blockchains like Ethereum and Solana as web3 becomes more mainstream.

If you’re interested in this topic, I’ve previously written extensively about the tradeoffs that web3 makes when it comes to handling user data.

2. Blockchains are Money Native and Borderless

Marc Andressen, cofounder of a16z, famously said:

the original sin was that we couldn’t actually build economics, which is to say money, at the core of the internet.

It was always difficult to move money around on the internet, which is why companies like Stripe, Adyen, and Paypal are so valuable.

In web3, blockchains are money native: the movement of money is central to the way they function. In addition, blockchains are not beholden to a specific country or geography: they are decentralized, permissionless protocols that are maintained through a set of independent parties worldwide.

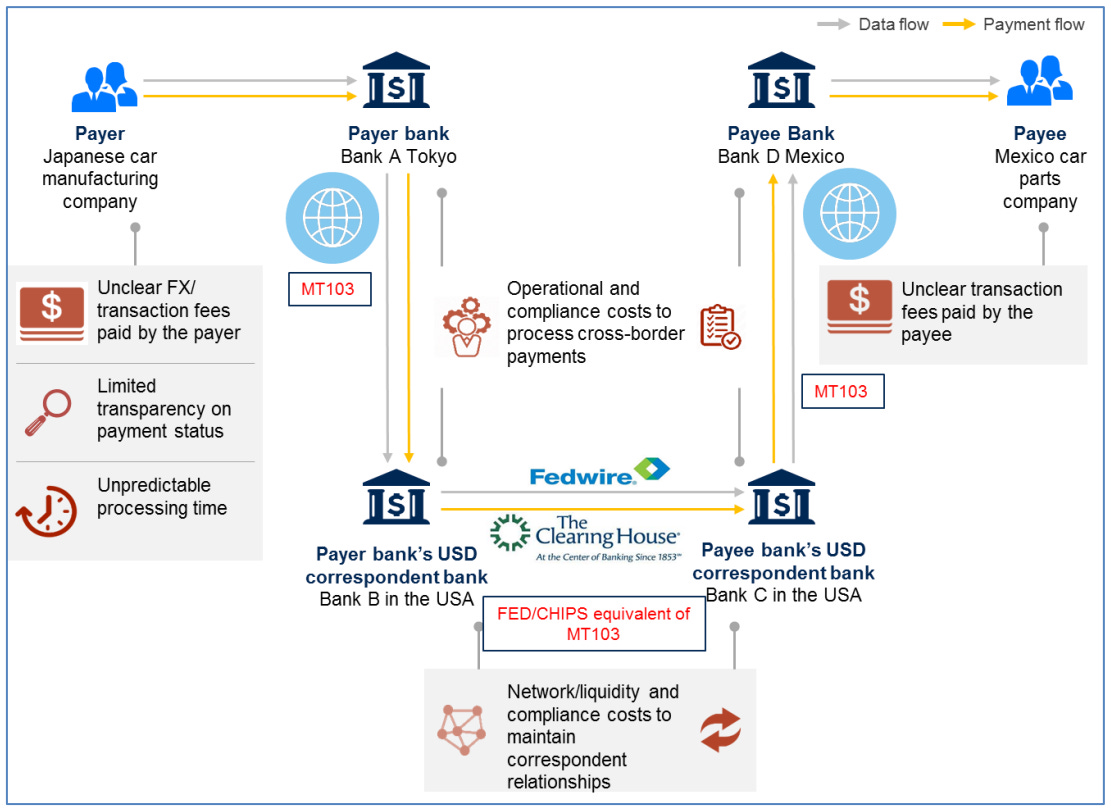

One of the clearest applications of this is how simple it is to make international money transfers in web3. Here’s how it currently works in the traditional financial system:

Yikes! With blockchains, I can send money to someone to any part of the world with one click. Furthermore, the fact that blockchains are money native and borderless enable individuals in less wealthy countries to hedge against inflation, invest in projects they wouldn’t normally have access to, and much more.

Counterpoint

The lack of centralized institutions governing money movement will lead to increased crime and a lack of accountability. With blockchains, there is no central bank that can magically perform a chargeback if you accidentally send money to the wrong place or have your private key stolen. Indeed, at least $1.9 billion has been stolen in crypto hacks this year, and that number is likely to be an underestimate.

3. Tokens Create Incentive Alignment

The introduction of crypto tokens has changed the way users can participate in and own parts of this new digital economy. As an early adopter of an application or a fan of a rising artist, you can 1) meaningfully show your support and 2) invest in the success of whatever you are supporting.

Web3 enables users to earn ownership in products and even people that they believe will do well in the future. They can do so via tokens, which can either be fungible or non-fungible (NFTs). Typically, users can acquire tokens in one of two ways:

Airdrops. Projects retroactively send tokens as rewards to their early adopters, such as with the Optimism Airdrop. In this case, users are rewarded monetarily purely because of their early contributions! (In some cases, tokens are also proactively sent, oftentimes in vampire attacks)

Purchasing. Users can invest in projects or people with the hope that their purchased token(s) will appreciate in value as the popularity of what they bought grows. While elements of this certainly exist in web2 (stock markets), web3 is unique in the way that it can tokenize almost anything! I wrote about this in my article about how the music industry is embracing NFTs.

In addition to users acquiring tokens, web3 projects also issue their own employees tokens as a form of compensation. Read more here.

Counterpoint

Tokens can lose value! What’s often lost in the web3 hype cycle is that tokens are inherently volatile assets that can be heavily influenced by factors entirely outside the holder or even issuer’s control. At least traditional stock markets are regulated! Easy mechanisms for people to buy unregulated assets paired with hype and disinformation is a toxic combination.

A Call to Action!

As you explore web3, you’ll form your own set of principles that help guide the way you analyze the space. If you’ve been in crypto for a while, you probably have a bunch already, and I’d love to hear them! Drop your favorite one in the comments.

What’d you think of this article? Great • So-so • Bad

Some personal news: I’ve recently left Stripe for a crypto startup. If you’re excited about working making blockchains easy to use for the next billion crypto users, please DM me @shekarramaswamy!

Thank you to Kristen for their contributions.