Coinsights #13: $SOS 🚨

Happy Holidays 🎄!

The crypto world clearly didn’t get the holiday break memo! Let’s talk about the hottest token right now: $SOS.

What is $SOS?

$SOS is the token for the OpenDao, which is described on the website as the “largest NFT community, to pay tribute, to protect, to promote...” (the ellipses is part of the description). More on what the project is trying to do later – what’s far more compelling is $SOS’s network effects.

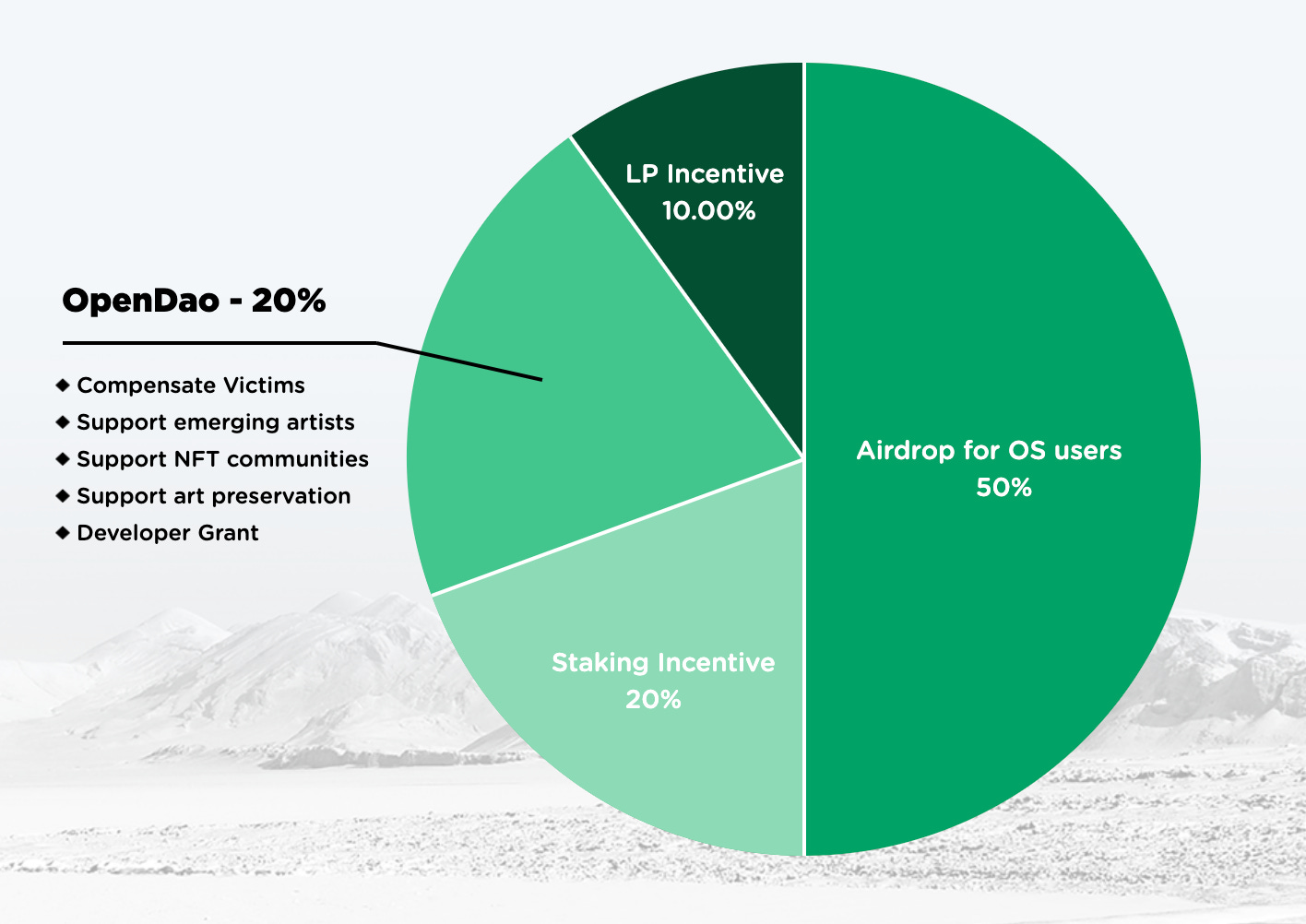

50% of all $SOS tokens are allocated to OpenSea users via airdrop. An airdrop means that you don’t need to pay for tokens but rather just go through a set up flow and receive them at your wallet address.

In this case, the amount of $SOS you can receive is directly proportional to the amount you’ve spent on OpenSea, a popular NFT trading platform. All you need to do is connect your wallet!

So why is this important?

Essentially, the OpenDao was able to bootstrap a NFT-focused community of $SOS token holders overnight by hooking into OpenSea’s existing popularity. Blockchain based apps uniquely enable this idea of community composability. From Alexis Ohanian, cofounder of Reddit (full thread):

Because everything is in a public database, it allows anyone to show up and reward behavior stored there.

I talked about a similar concept in an article on DeSo, which argues that the main reason that social product innovation has stagnated is because the data needed to bootstrap a new community today is heavily guarded by large tech companies. Again, from Alexis:

Now: Anyone can show up to a massively successful project and draft on their community and if you offer something more interesting / rewarding etc, leapfrog your way into a very motivated Minimum Viable Community overnight.

In a web3 world, founders can leverage hype marketing and the principle of ownership to kickstart communities faster than ever before. In addition, their target users’ addresses are publicly accessible! I’m not sure if the OpenDao founders did this, but I wouldn’t be surprised they proactively airdropped some $SOS to a few influencers to get the Twitter hype started.

To underscore how quickly OpenDao has grown, the project was launched a few days ago, and the Discord has almost 50k users. Furthermore, $SOS’s market cap is ~300M and its 24h trading volume is 470M!

The Potential Drawbacks

I have 3 concerns with what we’ve talked about so far.

Concern 1: The Rich Get Richer. The blockchain is supposed to “decentralize” and “democratize” access to wealth via a more transparent system. However, the $SOS token heavily favors those who have spent hundreds of thousands if not millions on OpenSea. That seems unfair?

However, someone could easily create a token that does the exact opposite. It’s unclear how the token will perform relative to $SOS, but there’s nothing in place to stop someone from creating a community that rewards smaller spenders on OpenSea. The data is all open!

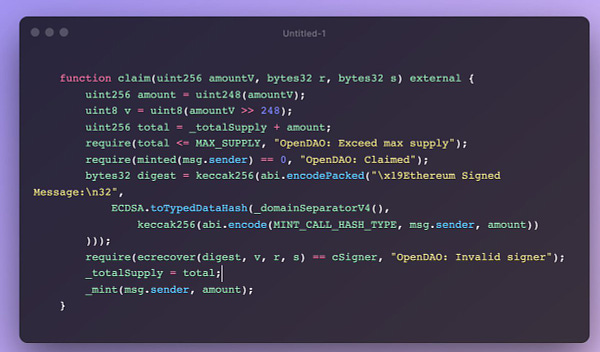

Concern 2: Scams. It’s difficult to tell which projects are scams without doing a deep dive through the code. $SOS does have some pretty clear red flags:

As far as I can tell, the founders are anonymous. In addition, it looks like half of all tokens are located in three wallets! $SOS seems especially vulnerable to a “pump and dump,” where speculation drives up the price of a token only for the larger holders to sell everything, causing a massive drop in price. Especially since anyone can launch a token fairly quickly, it’s much easier now to prey on mass FOMO and scam unsuspecting crypto users that desperately want in on the latest trend.

Over time there will ideally be some way for the average crypto user to verify the validity of a smart contract without sifting through code. Similarly, there should be a set of community accepted standards for the way token allocations are set up to make scams less likely to happen.

Concern 3: Community Composability. The fact that it’s so easy to bootstrap a community off of another makes me wonder if owners will want to somehow start keeping their communities private. (I don’t know how this would work in practice since blockchain transactions are public. Something like IronFish comes to mind, although I don’t fully understand it yet). Given the ethos of web3, consumers will likely rebel against the fact that their data is yet again being walled into a specific application.

Nothing is stopping someone from creating another community on top of OpenDao but offering slightly better incentives (or simply having fewer red flags). On one hand, I understand how this “composability of communities” greatly benefits consumers in that they are free to choose the project that best suits them with marginal switching costs. That is powerful! However, I do feel for the founder who has spent months curating a community only to see it disappear overnight to someone else who can offer better fees and experiences. I wrote earlier:

The strongest moat in web3 is the community, not the underlying tech or data.

I’d like to revise that statement: The only moat in web3 is a loyal community.

Thanks for reading! Do you agree with the takes in this article or have some feedback? Come chat in the Coinsights Discord or leave a comment!